Welcome!

Are you ready to be free?

Free To Focus On Sales, Marketing, Customers, Product or Service Development?

Free From Being Behind On Your Accounting?

Free From Getting Ambushed By Cash Flow Issues?

Free From Not Knowing What You Need To Know To Make Smarter Financial Decisions About The Future of Your Business?

We help clients build successful, profitable businesses, and ultimately help you achieve the goals of the business.

We help you see ahead and collaborate with you on where to invest in your business so that you can make confident decisions.

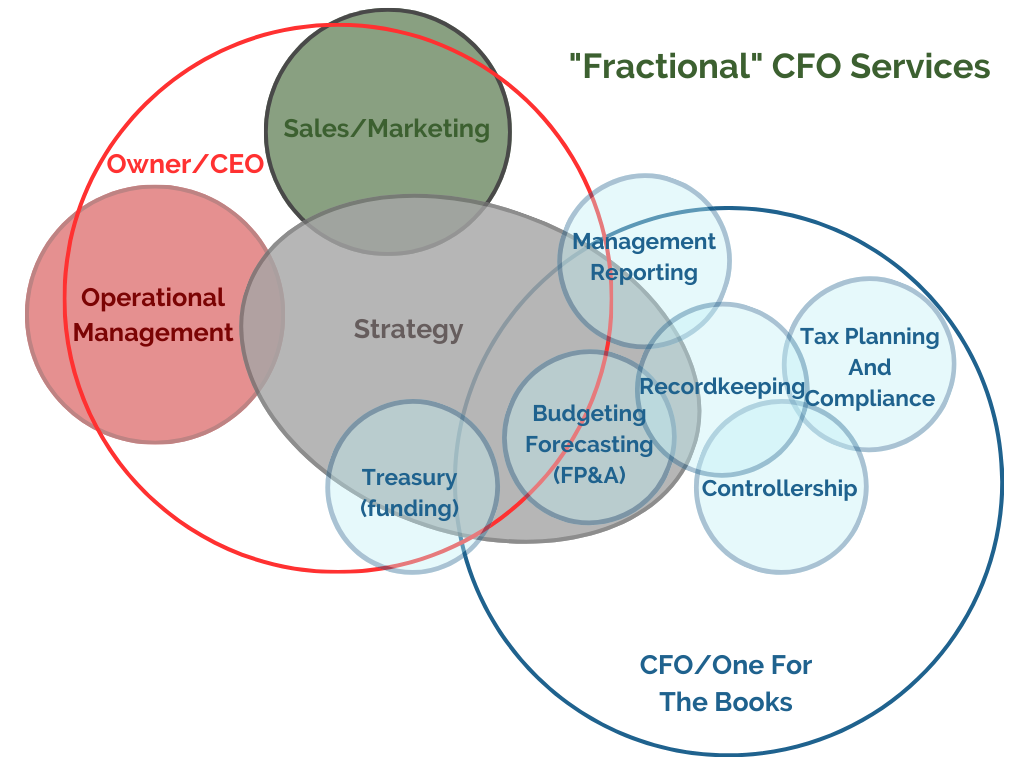

Advisory Services

Cash Flow Management: Build cash flow modeling specific to your business to help you make informed spending decisions based on projected customer payments, vendor payables and your overhead expenses.

Virtual CFO: Management reporting and advice to support growth.

Deeper Profit and Loss Analysis to look at what business is really “good business” for the your company from a margin or cash flow standpoint

CPA Advisory: While we are not CPA’s, we partner with one of the best in Houston, if you need a CPA to file your business (and personal) taxes.

Forecasting vs. Budgeting - What's The Difference?

Budgeting: Budgeting involves allocating expenditures for a set period of time from detailed accounting line items. Budgets help companies manage their month-to-month expenditures.

You Need Both: We can help you formulate a budget AND build a forecast model that we monitor and evolve over time as an iterative process for setting targets and holding the business accountable. We tie it to your accounting data in real time so that you can see how you’re performing against your goals. The forecast will also help you to anticipate shifting market trends and gain a competitive advantage.

Forecasting: Forecasting is the process of making educated guesses and using financial modeling to create projections. Forecasts are STRATEGIC. They help companies manage long-term goals and growth.

Model “What If…?” Scenarios: How long will your cash last in an economic crisis? Can you afford to hire new staff right now? What will adding new revenue streams to your business look like? We routinely model new potential future versions of the business for our clients.

Day-To-Day Management

Bookkeeping: Integrate daily banking, credit card expense and sales/income transactions into your accounting with correct account classification.

Sales Tax: Regular filing and payment of state/local sales taxes.

Employee/owner expense report processing

Loan Account Management: such as construction loans, vehicle/equipment loans: both loans owed BY the business/liabilities or TO the business/assets – tracking interest and principal allocations to the loan and regular reconciliation against loan statements if they are through a bank.

WORK-IN-PROGRESS (WIP) based accounting: accrual and timing of expenses on long term projects such as real-estate development or long-term product/project life cycles to coincide with revenue/sales to avoid swings in revenue recognition and tax liability

Payroll: Management of payroll and taxes. Can also include management of employee advances, child support payments, cafeteria-plan payments, employee insurance payments or other pre-tax deductions from payroll

Customer estimates/PO requests, invoicing, and follow-up on outstanding payments

Setting up fixed assets for depreciation (land/property, vehicles, tools/equipment

Input Of Vendor Invoices and Payables: Includes onboarding of new vendor’s W-9 forms and payment terms, 1099 reporting where applicable at the end of the year

Start-Ups

Business Formation: Corporate Agreement creation, filing your LLC or Corporation with your state, Federal EIN

Accounting Software Selection: We can help you only pay for what you need, while not missing out on key features that will optimize your understanding of the business or help things run more efficiently.

Integration Of Your Accounting Software With Other Apps: Time tracking for your hourly employees, expense/receipt tracking, online retail such as Shopify, etc.

Set-Up Merchant Services: Ability to take credit card and ACH payments online/in-person

Set-Up Accounting From “Day Zero”: We’ll take the time to understand your business and build a framework for the organization of your bookkeeping based on how you work.

Client Training On Basic Accounting Principles: Our clients come to us because they don’t want to “be” or “do” the accounting. However, most clients have a desire to “get” the numbers beyond face value and have an informed opinion about how the business should be tracked financially. We coach you on this throughout our engagement IF you want to understand it deeper.